The Home Currency Scam

With the global rise in popularity for credit/debit card payments, many businesses, both big and small, have found a way to separate consumers from more of their cash. I call it the home currency scam.

Don’t freak out… yet. This only applies when you are using a credit/debit card that has a different currency attached to it than the vendor’s local currency. So, you won’t experience this scam if you are using your American credit/debit card in the US.

Rather, you will experience this scam if you try to buy something in, or from, another country.

How the It Works

A vendor, either in person or on the web, will show you your total when paying by credit/debit card.

Instead of showing the cost in the local currency, they will have changed it to display the currency of where the card is from. So, you might be on a layover in Doha at the airport buying a coffee, but instead of seeing your total in Qatari Riyal it’s in US dollars. You might find it comforting to see your total in a recognizable currency, but there is something more sinister at play here.

Normally, many* credit/debit card companies will convert foreigner purchases for customers with no additional fees and at the actual exchange rate when the purchase was made. Think of it as a service or perk the credit card company does for their clientele. What the vendor is actually doing is inserting themselves as a middleman in that process. If they perform the currency conversion, then they can control the exchange rate and charge you anything they think they can get away with.

*Some credit/debit card companies with charge a Foreign Transaction Fee. Check your terms & conditions.

The Home Currency Scam in Action

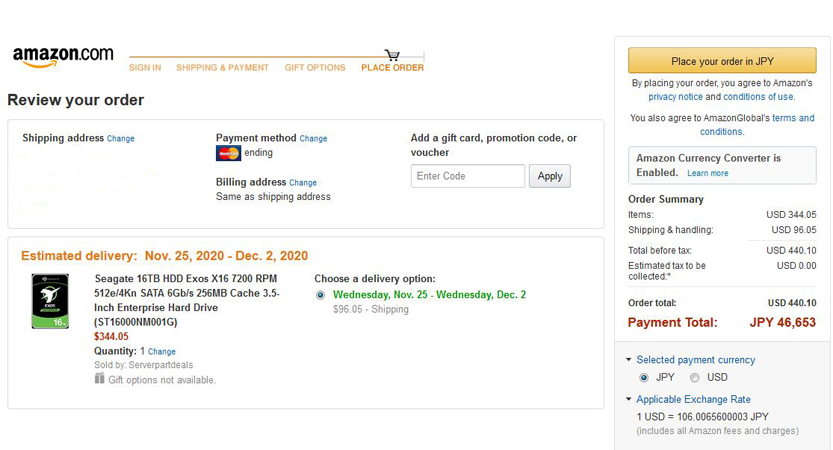

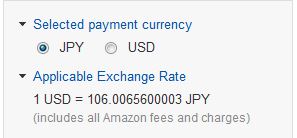

The above screenshot from my Amazon.com checkout is a perfect example. After inputting my credit card, it knows my card is from Japan. On the payment page, Amazon.com defaults to paying in yen, rather than dollars. I am very familiar with the exchange rate between these currencies, and the conversion looks pretty close to the actual exchange rate. At least close enough that it doesn’t raise any red flags.

However, that doesn’t mean I’m getting a fair exchange rate. Far from it, in fact. When I checked the actual rate, I found that Amazon.com was charging around a 2.5% conversion fee.

Does Size Matter?

You might be thinking, 2.5% isn’t that big of a deal. If you’re happy being charge more money for the same product/service than the next person in line, than I guess there is little I can do to change your mind. This also falsely assumes that a merchant won’t try to extort a higher exchange rate, perhaps something as high as 6% to 10%. Amazon.com might not be that brazen, but there are more unscrupulous businesses out there. It’s a safe bet that jetlagged travelers won’t be able to do the math on a currency conversion for an already overpriced food item in a busy airport with a line of grumpy people waiting behind them.

Clearly these micro transaction scams do add up over time. This of course all depends on how much you’re using your credit/debit card and the percentage a vendor is levying in the currency conversion. Potentially over the course of a year, it’s a scam that could end costing you hundreds of dollars over multiple transactions.

Further, it’s a deceptive and dishonest practice. The company is not adding any value to the transaction by doing this. They are simply creating a way for them to rob you of money.

How to Avoid The Home Currency Scam

Fortunately, this is an easy scam to avoid. It’s as simple as always electing to pay in the local currency. Reputable websites will give you an option when checking out; though it’s a good bet the default is set to paying in your home currency. It’s important to pay close attention and always assume that any business doesn’t have your best interest in mind.

In brick and mortar locations cashiers might give a verbal option when swiping your card. Asking, ‘Would you like to pay in Riyal or dollars?’ Confused tourists will opt for the familiar, but hopefully now you know what the correct choice should be.

A more difficult situation is when a devious merchant makes the choice for you when paying at a physical location. I’ve experienced this at airports, but I don’t fully blame the people working the register. It’s no stretch of the immigration to believe that the staff has been strong-armed into doing this by their higher-ups.

When this happens, ask the staff to change the transition to the local currency. If they say that they can’t, simply walk away and buy what you need from another shop.

That might sound a tad harsh, but keep in mind they are trying to rip you off.

While you’re here, why not check out some of other REVIEWS or TRAVEL WRITE UPS from around the world.